s corp tax rate calculator

This rate 153 is a total of 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. Stewart Title Insurance Company - Rate Calculator for the State of New York.

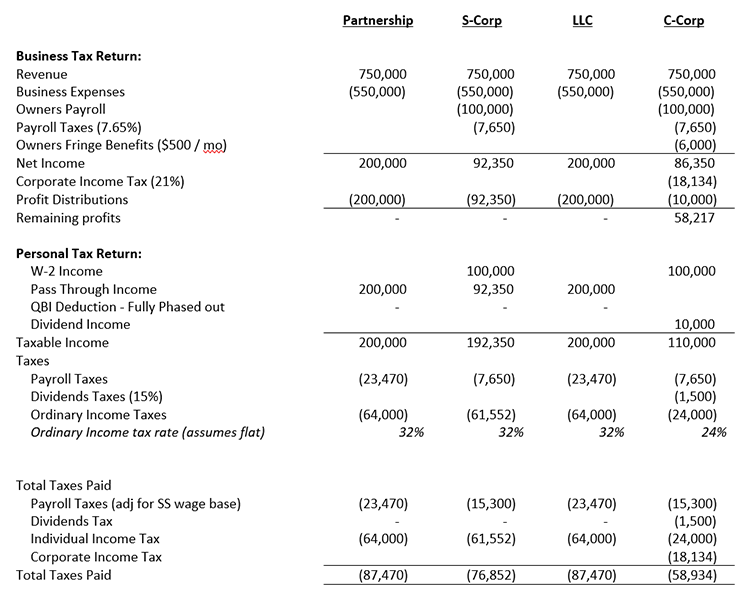

S Corporation Tax Calculator S Corp Vs Llc Savings Truic

If you are a nonresident or part-year resident you must complete Form.

. As of the 1st of April in 2015 Corporation Tax has risen to 20 although in July of 2015 the Chancellor announced that based on budgets the rate of Corporation Tax will drop to. Estimated Local Business tax. Additional Self-Employment Tax Federal Level 153 on all business income.

The average cumulative sales tax rate in Piscataway New Jersey is 663. Total first year cost of S-Corp. S corporations are corporations that elect to pass corporate income losses deductions and credits through to their shareholders for federal tax purposes.

Basic Corporate Income Tax Calculator BTC BTC for Companies Filing Form C-S. How Do I Calculate the Effective Tax Rate for My Corporation. For example if you have a.

Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses. The SE tax rate for business owners is 153 tax. Avalara AvaTax can help you automate sales tax rate calculation and filing preparation.

This additional tax covers Social Security Medicare taxes that would normally be paid on your W2 income S. Annual state LLC S-Corp registration fees. S Corporation Subchapter S and S Corp Tax Rate.

This includes the rates on the state county city and special levels. S45 Double Taxation Relief Tax Rate Calculator for. C-Corp or LLC making 8832 election.

Partnership Sole Proprietorship LLC. Ad Get the benefit of tax research and calculation experts with Avalara AvaTax software. S corporation the S corporation should provide your proportionate share of the S corporations depreciation deduction.

YA 2022 XLSM 298KB YA 2021 XLS 130MB. S-Corp or LLC making 2553 election. Check each option youd like to calculate for.

An S corporation S corp is a tax structure under Subchapter S of the IRS Internal Revenue Service for federal state and. Gross to Net Net to Gross Tax Year. Piscataway is located within Middlesex County.

OLPMS - Instant Payroll Calculator. You can figure out the effective tax rate for your corporation by dividing the cost of taxes by the pre-tax earnings. Annual cost of administering a payroll.

How Much Does A Small Business Pay In Taxes

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

The Basics Of S Corporation Stock Basis

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

Effective Tax Rate Formula Calculator Excel Template

Llc Tax Calculator Definitive Small Business Tax Estimator

Corporate Tax Meaning Calculation Examples Planning

![]()

S Corp Vs C Corp Which Is Best Excel Capital Management

What Is Double Taxation For C Corps The Exciting Secrets Of Pass Through Entities Guidant

S Corp Payroll Taxes Requirements How To Calculate More

S Corp What Is An S Corporation Subchapter S

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Effective Tax Rate Formula And Calculation Example

Determining The Taxability Of S Corporation Distributions Part I

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube